XRP Price Prediction: Bulls Target $8 as Technical and Fundamental Factors Align

#XRP

- Technical Outlook: XRP must reclaim its 20-day MA and upper Bollinger Band to confirm bullish momentum.

- Institutional Catalyst: ETF speculation and Ripple's legal wins are driving long-term optimism.

- Risk Factor: Broader market liquidations and MACD divergence pose short-term downside risks.

XRP Price Prediction

XRP Technical Analysis: Key Indicators to Watch

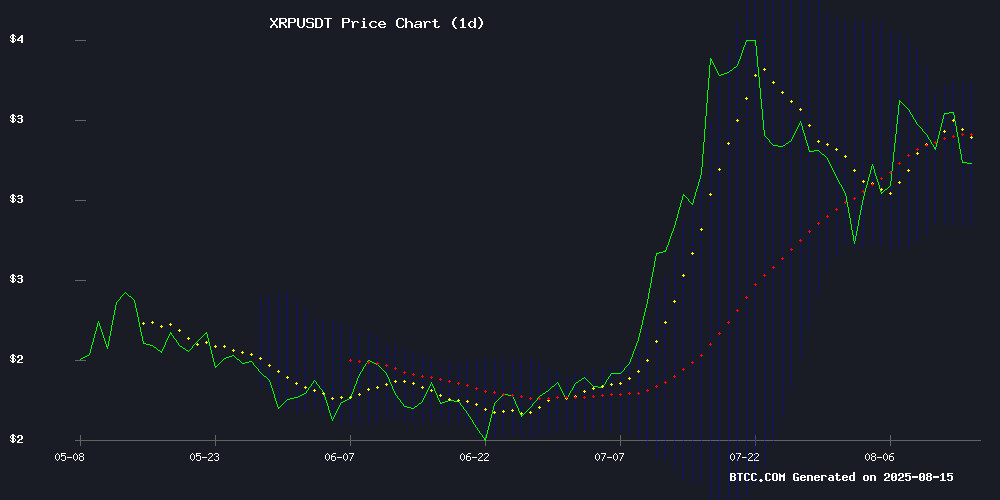

XRP is currently trading at 3.09940000 USDT, slightly below its 20-day moving average (MA) of 3.1091, indicating a neutral to slightly bearish short-term trend. The MACD (12,26,9) shows a negative histogram (-0.0473), suggesting weakening momentum, though the signal line (0.0696) remains above the MACD line (0.0223). Bollinger Bands reveal a tightening range with the price hovering NEAR the middle band (3.1091), while the upper (3.3827) and lower (2.8355) bands suggest potential volatility ahead. According to BTCC financial analyst Emma, 'A decisive break above the 20-day MA could signal a bullish reversal, while failure to hold the middle Bollinger Band may lead to a test of support at 2.8355.'

XRP Market Sentiment: Bullish Catalysts Amid Volatility

Recent headlines highlight mixed sentiment for XRP, with bullish catalysts like institutional accumulation, ETF hype, and legal clarity from the SEC case offset by short-term sell pressure. BTCC financial analyst Emma notes, 'The community is optimistic about Ripple's long-term prospects, especially with CTO advocacy for permissionless blockchains and the $3.33 breakout target. However, the 7% drop amid broader market liquidations reminds traders of near-term risks.' Key themes include price targets of $5.85 and $8, though Emma cautions that 'these levels require sustained institutional interest and a clean break above technical resistance.'

Factors Influencing XRP’s Price

SWIFT Executive’s Cryptic Remark on Ripple’s Rail Acquisition Sparks XRP Community Debate

Ripple’s $200 million acquisition of Rail, a stablecoin-focused firm, has drawn a pointed response from SWIFT’s Chief Innovation Officer Tom Zschach. The executive’s LinkedIn comment—"Another ‘checkmate’ moment"—fueled speculation about whether it signaled acknowledgment or skepticism toward Ripple’s growing influence in cross-border payments.

The XRP community dissected Zschach’s follow-up remark that the payments race is "nowhere NEAR over," interpreting it as either a competitive jab or validation of Ripple’s strategic move. The acquisition underscores intensifying rivalry between traditional financial infrastructure and blockchain-based solutions.

Market observers note the deal positions Ripple to leverage Rail’s technology for liquidity management, potentially accelerating the decline of legacy systems like SWIFT. Regulatory scrutiny remains a shared challenge for both incumbents and disruptors in the space.

XRP Price Targets Spark Enthusiasm in the Crypto World

XRP's potential to reach $1,000 has reignited debate among crypto enthusiasts. Manhar Garegrat, Country Head of Liminal Custody, calls the target "speculative but not impossible," stressing it would require a seismic shift in global financial infrastructure. Currently trading at $3.11, XRP faces resistance at $3.40 with support between $2.85-$3.12.

Garegrat acknowledges XRP's ambition to become a global payment standard but cautions that $1,000 predictions remain divorced from current realities. "Ripple's technology complements existing systems—it won't replace SWIFT outright," he notes. The path forward hinges on regulatory breakthroughs, interoperability, and gradual adoption of faster, cheaper value transfers.

XRP Price Prediction: Institutional Accumulation and Technical Strength Signal Potential Rally

XRP demonstrates resilience amid market turbulence, holding critical support at $3.05 despite a 5% daily drop. Whale entities accumulated 320 million tokens during the downturn, signaling strong institutional conviction. The SEC's closed case against Ripple continues to buoy sentiment, contributing to an 8% weekly gain.

Technical analyst Tony Severino identifies a bullish pattern projecting a $13 target by mid-September. The RSI at 59 confirms building momentum without overbought conditions. Market structure remains constructive after surviving a $1 billion liquidation event that briefly pushed prices to $3.09.

Exchange activity shows concentrated buying at key levels, particularly as the asset rebounded from multiple tests of the $3.05 support zone. The recent price action forms a potential springboard pattern historically associated with major upside resolutions in cryptocurrency markets.

XRP Tumbles 7% Amid $1B Crypto Market Liquidation Storm

XRP plunged to weekly lows as a cascade of liquidations rattled digital asset markets, with over $1 billion in positions unwound across major cryptocurrencies. The selloff accelerated during midday trading as XRP volume spiked to 436.98 million units—one of the largest hourly prints this quarter—before finding tentative support near $3.05.

Ripple's CTO attempted to shore up sentiment by reaffirming the XRP Ledger's institutional readiness, though technical weakness prevailed as prices tested critical support levels. The broader retreat mirrored profit-taking in U.S. equities, underscoring persistent correlation between risk assets.

Late-session buying emerged as liquidation pressures eased, with XRP recovering from $3.09 after establishing a narrow consolidation range. Market participants now watch whether this represents transient bargain-hunting or renewed accumulation by strategic holders.

XRP Price Surges on ETF Hype as Institutional Interest Grows

XRP's recent rally stems from mounting optimism around exchange-traded funds, with ProShares Ultra XRP (UXRP) now trading on NYSE Arca and Teucrium XXRP ETF surpassing $500 million in assets. This institutional endorsement has propelled the token past crucial resistance levels between $3.50-$4.00.

Technical indicators flash bullish signals, including a golden cross in the MVRV ratio—a classic momentum precursor. Analysts now eye $6 as a viable target should current buying pressure persist. Whale activity corroborates the uptrend, with one $498 million transfer signaling heavyweight accumulation.

Short-term projections suggest a decisive breakout above $4 could catalyze moves toward $5, though some forecasts envision triple-digit valuations pending broader adoption. While ETF inflows and technicals fuel the rally, sustained momentum hinges on continued institutional participation.

XRP Nears Critical $3.33 Breakout Level as Analyst Predicts Rally to $5.85

XRP hovers near $3.29, testing a decisive resistance level at $3.33 that analyst Dark Defender identifies as the launchpad for a potential surge to $5.85. The cryptocurrency has repeatedly challenged this barrier since July's $3.65 peak, with recent price action showing weakening selling pressure as it breaks above a descending trendline.

Technical indicators reinforce the bullish case. The 50% Fibonacci retracement at $3.2039 provides robust support, while the Ichimoku Cloud's green zone between $2.92-$3.20 remains intact. Momentum continues building as the Relative Strength Index crosses above its signal line, suggesting growing buyer conviction.

Market participants await a confirmed breakout above $3.33, which could accelerate gains toward higher Fibonacci extension targets. Failure to hold current levels would see XRP retest support zones, though the technical setup currently favors upside potential.

XRP Price Prediction: Bulls Target $8 Breakout Following SEC Legal Resolution

XRP surged 3.10% to $3.33, breaking through key resistance at $3.27 on triple-average trading volume. The rally follows Ripple and the SEC formally ending all appeals, removing a years-long overhang on the token.

Technical patterns suggest a nearly complete cup-and-handle formation with an $8-$11 target. Institutional buying fueled the breakout, though profit-taking emerged near the session high of $3.34. CEO Brad Garlinghouse notes expanding global payment partnerships could accelerate with regulatory clarity.

Ripple CTO Advocates for Permissionless Blockchains Like XRPL in Future Finance

David Schwartz, Ripple's Chief Technology Officer, underscores the enduring relevance of public, permissionless blockchains such as XRPL in shaping programmable finance by 2025. Amid a surge in payment-focused and stablecoin-specific chains, Schwartz emphasizes XRPL's unique positioning—combining openness with real-world utility to drive industry growth.

Permissionless architectures like XRPL outperform restricted validator models in resilience and global reach, Schwartz argues. The blockchain's decade-long evolution has cemented its role as critical infrastructure for financial systems, balancing decentralization with institutional-grade reliability. "XRPL's traction stems from being battle-tested," he notes, highlighting its adaptability for seamless transactions.

XRP Breaks Key Resistance After Ripple-SEC Win — Is $8 Next?

XRP extended its bullish momentum, climbing 3.10% from $3.24 to $3.33 amid heightened institutional activity. The breakout through $3.27 resistance on triple-average volume signals strong accumulation, with fresh support forming at $3.33.

Market structure shifts reflect growing institutional participation, drawing comparisons to XRP's 2017 bull run. Analysts now eye $6-$8 targets as Ripple's legal victory removes regulatory overhangs.

Price action carved a 4.20% volatility corridor, with aggressive moves at 13:00 UTC triggering 217.4 million volume—a clear institutional footprint. Overnight sessions maintained elevated activity, reinforcing the uptrend.

How High Will XRP Price Go?

XRP's price trajectory hinges on both technical and fundamental factors. Below is a summary of key levels and catalysts:

| Scenario | Price Target | Condition |

|---|---|---|

| Bullish Breakout | $5.85 - $8.00 | Clearance of $3.33 resistance, sustained institutional inflows |

| Neutral Consolidation | $2.83 - $3.38 | Range-bound trading within Bollinger Bands |

| Bearish Rejection | $2.50 (support test) | Failure to hold middle Bollinger Band |

Emma emphasizes, 'The $3.33 level is critical—a weekly close above it could accelerate momentum toward $5.85, while rejection may prolong consolidation.'

| Scenario | Price Target | Condition |

|---|---|---|

| Bullish Breakout | $5.85 - $8.00 | Clearance of $3.33 resistance, sustained institutional inflows |

| Neutral Consolidation | $2.83 - $3.38 | Range-bound trading within Bollinger Bands |

| Bearish Rejection | $2.50 (support test) | Failure to hold middle Bollinger Band |